Business Insurance in and around St Louis

Looking for protection for your business? Look no further than State Farm agent Mike Balota!

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

Preparation is key for when an accident happens on your business's property like a customer slipping and falling.

Looking for protection for your business? Look no further than State Farm agent Mike Balota!

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

Protecting your business from these possible mishaps is as easy as choosing State Farm. With this small business insurance, agent Mike Balota can not only help you devise a policy that will fit your needs, but can also help you submit a claim should an issue like this arise.

Do what's right for your business, your employees, and your customers by getting in touch with State Farm agent Mike Balota today to investigate your business insurance options!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

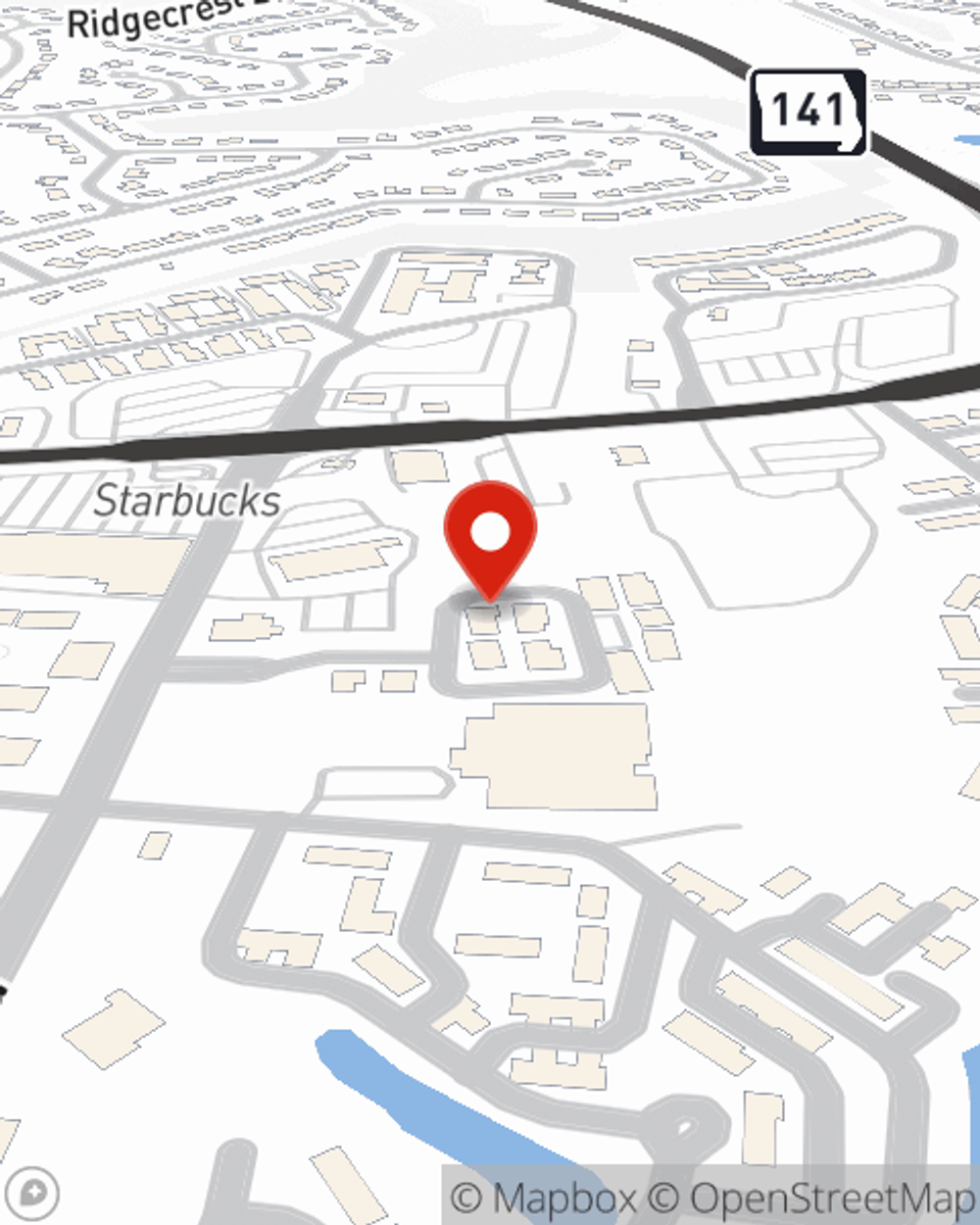

Mike Balota

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.