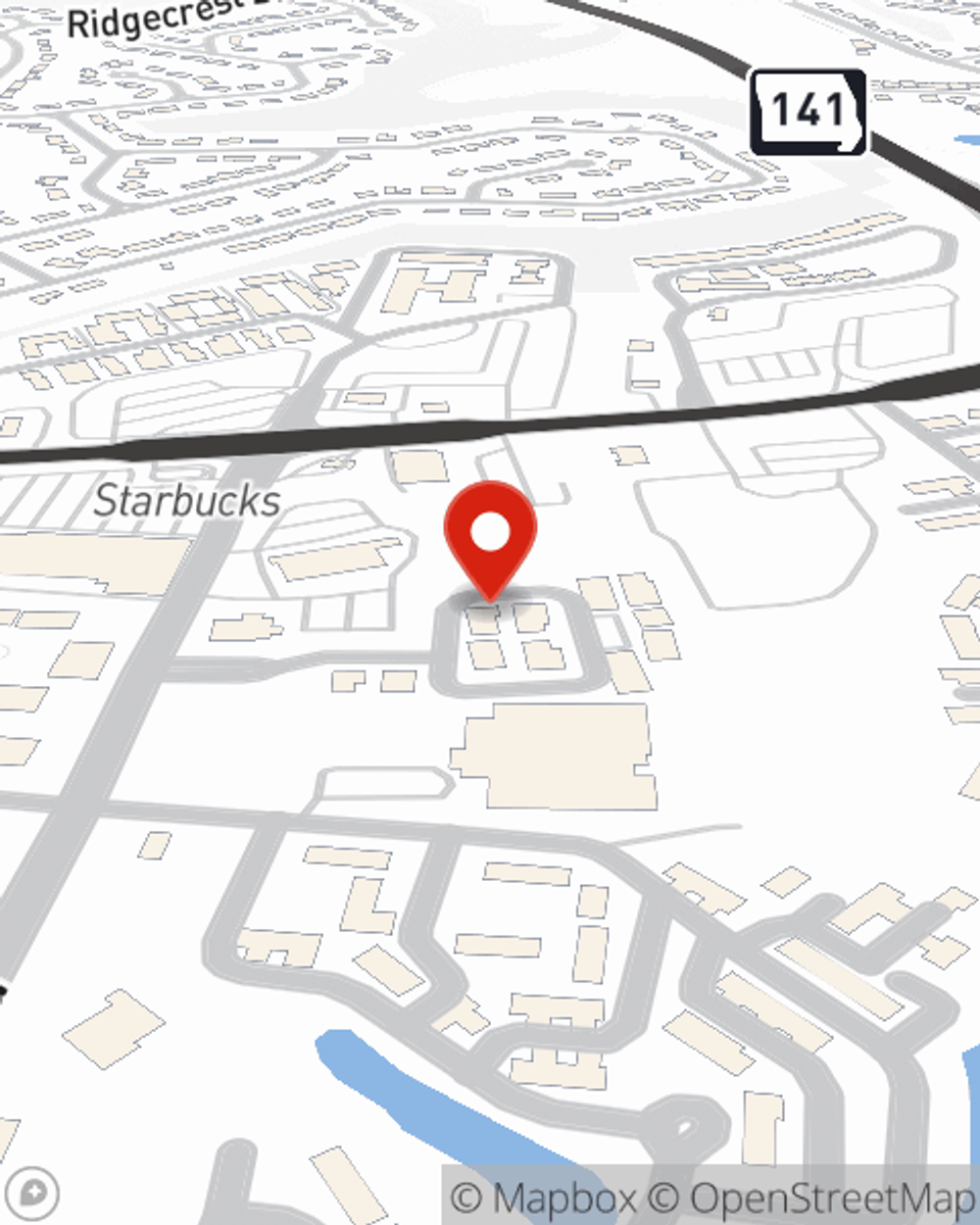

Business Insurance in and around St Louis

Researching protection for your business? Look no further than State Farm agent Mike Balota!

This small business insurance is not risky

Insure The Business You've Built.

When you're a business owner, there's so much to consider. We understand. State Farm agent Mike Balota is a business owner, too. Let Mike Balota help you make sure that your business is properly insured. You won't regret it!

Researching protection for your business? Look no further than State Farm agent Mike Balota!

This small business insurance is not risky

Get Down To Business With State Farm

For your small business, whether it's a meat or seafood market, an art gallery, an antique store, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like extra expense, loss of income, and business liability.

Contact State Farm agent Mike Balota today to learn more about how a State Farm small business policy can ease your business worries here in St Louis, MO.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Mike Balota

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.